As global demand for Organic Essential Oils surges driven by consumer preferences for natural, sustainable wellness products—Vietnam emerges as a strategic yet complex sourcing destination. With its abundant biodiversity and traditional knowledge in herbal medicine, the country holds strong potential to become a leading Essential Oil exporter. However, producing organic-grade oils at scale, compliant with rigorous EU and US market standards, presents multiple challenges.

This article explores the core barriers Vietnamese manufacturers face in producing certified organic oils, from fragmented supply chains and outdated distillation methods to regulatory gaps and climate vulnerabilities. Drawing from the experience of leading producers like Techvina, we uncover how the industry is navigating quality assurance, certification, and innovation to serve international buyers with transparency and consistency.

1. Fragmented Supply Chain & Raw Material Sourcing

1.1 Unstable Organic Cassia Sources

Vietnam ranks third globally in cassia production, but farms remain small-scale and spread across regions. This fragmentation leads to inconsistent yield and aroma chemistry profiles, making it hard to stabilize batch quality crucial for buyers prioritizing Essential Oil authenticity.

>> Related article:

A STORY OF HONESTY IN THE NATURAL CHEMICAL PRODUCTS INDUSTRY

SUSTAINABLE CASSIA DEVELOPMENT IN VIETNAM

1.2 Pesticide Residues & Certification Demands

European buyers demand certified Organic Essential Oils. However, lack of unified pesticide controls in Vietnam increases the burden on producers to ensure residue-free raw materials. Costs and bureaucracy in obtaining USDA/EU organic certification remain significant barriers.

1.3 Weak Farm-to-Factory Logistics

Climate events like the Yagi storm have disrupted cassia harvests and damaged distillation facilities. Combined with manual, multi-step collection from remote cooperatives, these factors slow logistics and risk oil degradation before processing.

>> Related article: Impact of Yagi Storm on Vietnam’s Cassia Oil Industry

2. Quality Control & Aroma Chemicals Consistency

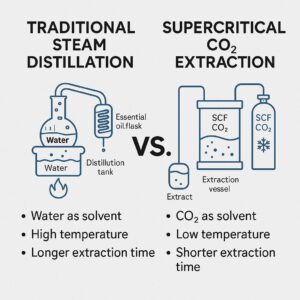

2.1 Extraction Process Variability

Many Vietnamese distillers still use traditional steam distillation. Techvina applies a rigorous 5-step QC system—from field sourcing to final product testing—to manage deviations in key aroma chemicals like cinnamaldehyde. Still, traditional methods struggle to ensure consistency across batches.

2.2 Gaps in Laboratory Standardization

Techvina invests in GC/GC-MS labs and retains samples for traceability. Yet, compliance with international lab standards like IFEAT or FEMA requires heavy investment, often out of reach for smaller producers.

2.3 Competition from Aroma Chemicals & Synthetics

Global fragrance and flavor buyers often opt for cheaper, consistent synthetic aroma chemicals. For Vietnam Essential Oil producers to compete, they must demonstrate authentic chemical profiles, transparent sourcing, and credible lab-sourced organic oil data.

3. Production Costs & Technology Barriers

3.1 High Input and Value Chain Costs

Labor and fuel costs are increasing. For example, raw material and processing costs in 2025 have already risen by about 15%. Each step from farm to oil—collection, storage, distillation, and packaging—adds cost, making Vietnamese oils less price-competitive.

3.2 Lack of Advanced Extraction Technology

Steam distillation remains dominant with 60-65% efficiency and poor control over active compounds. Advanced methods like Supercritical CO₂ and SFE deliver superior aroma chemicals but require hundreds of thousands in investment and high technical capacity. Techvina is piloting CO₂ extraction at small scale.

3.3 Certification & Compliance Costs

Certifications like USDA Organic, EU Organic, FSSC 22000, Kosher, and Halal not only involve fees but also infrastructure upgrades, audit systems, and ongoing traceability documentation—barriers for small producers.

4. Legal Framework & Environmental Risks

4.1 Lack of Clear Legal Framework

Vietnam has no specific legal framework for Organic Essential Oils, relying instead on general organic agriculture standards. Producers must self-implement international criteria like pesticide residue < 0.01 ppm and harvest condition controls.

4.2 Labeling & Traceability Requirements

EU Regulation 2018/848 and USDA guidelines require full COA documentation per lot: chemical profile (e.g. cinnamaldehyde ≥ 65%), botanical source, harvest date, and expiry. This necessitates digitized record-keeping systems.

4.3 Environmental & Climate Vulnerabilities

Floods, storms, and droughts damage plantations and reduce yield quality. The Yagi storm in 2023 exemplified this, causing fungal infections and logistics delays. These risks increase insurance costs and variability in oil quality.

5. Technical Expertise & Workforce Capacity

5.1 Lack of Aroma Chemical R&D Experts

Vietnam lacks trained chemists and product developers to create competitive aroma blends. Techvina collaborates with international labs to research chemical isolates and ensure traceable GC/GC-MS data.

5.2 Limited Training for Farmers & Factory Workers

Most cassia farmers are unfamiliar with Good Agricultural and Collection Practices (GACP). Factory workers often rely on manual techniques, hindering GMP/HACCP compliance.

5.3 Poor Digital Management & Traceability

Digital transparency is essential for global buyers. Techvina is implementing ERP systems to track farm origin, harvest data, and chemical profiles per batch, creating a competitive edge.

6. Techvina’s Strategic Solutions

| Challenge | Techvina’s Solution | Buyer Benefit |

| High cost & variability | CO₂ extraction + strict QC | Consistent, premium-quality oil |

| Traceability & trust | ERP + GACP + sample archives | Full documentation for audits |

| Aroma innovation | R&D with international labs | Custom blends with verified

specs |

Beyond these initiatives, Techvina is also expanding its cooperative farming network to ensure certified organic raw materials, establishing training centers for sustainable cultivation, and actively participating in global exhibitions to foster transparency and build buyer confidence. These steps collectively enhance Techvina’s credibility and position Vietnam as a trustworthy hub for organic essential oils.

Conclusion

Despite challenges in cost, legal structure, and technical capacity, Vietnam’s Organic Essential Oil industry—led by exporters like Techvina—is evolving with targeted investments in technology, certification, and traceability. Buyers seeking transparency and authenticity will benefit from suppliers who embrace global standards while leveraging Vietnam’s unique botanical resources.