1. Why Vietnam’s Essential Oil History Matters

Vietnam’s essential oil industry has evolved from ancient traditions to a modern, export-driven sector. Understanding this history provides insights into the country’s current capabilities and future potential in the global market.

2. The Origins of Essential Oil Use in Vietnam

2.1. Ancient Herbal Traditions and Cultural Roots

Vietnam’s use of aromatic plants dates back centuries, deeply rooted in traditional medicine practices. Communities across the country have utilized native plants like cinnamon, lemongrass, and ginger for their therapeutic properties. Ethnic minorities, such as the Dao and Hmong, have unique traditions involving essential oils, contributing to the rich tapestry of Vietnam’s aromatic heritage.

2.2. Early Extraction Techniques

Traditional methods of extracting essential oils involved steam distillation using rudimentary equipment like clay pots and bamboo tubes. These techniques, passed down through generations, laid the foundation for the country’s essential oil production.

3. Development of the Essential Oil Industry (1950s – 1990s)

3.1. Influence of French Colonial and Soviet Techniques

During the French colonial period, more efficient distillation methods were introduced, enhancing the quality and quantity of essential oils produced. Post-independence, Soviet-influenced cooperatives further developed the industry, focusing on the cultivation and processing of aromatic plants.

3.2. Government-Led Agricultural and Forestry Initiatives

The Vietnamese government initiated programs to promote the cultivation of essential oil-bearing plants, particularly in northern and central provinces. State-owned enterprises played a significant role in exporting oils like lemongrass and eucalyptus, establishing Vietnam’s presence in the global market.

4. Modernization and Global Expansion (2000 – Present)

4.1. The Rise of Private Manufacturers and Exporters

The turn of the millennium saw the emergence of private companies specializing in essential oil production. These enterprises, such as Techvina, have expanded Vietnam’s reach, exporting high-quality oils to markets in the US, EU, Japan, and South Korea.

4.2. Technology and Quality Standards Upgrades

Modern Vietnamese essential oil producers have adopted advanced technologies, including stainless steel distillation systems and GC-MS testing, to ensure product purity and consistency. Compliance with international certifications like USDA Organic, ISO, and GMP has become standard practice, enhancing Vietnam’s reputation as a reliable supplier.

4.3. Key Production Regions Today

According to information announced by Techvina, Vietnam’s essential oil production is concentrated in several strategic regions:

- Hung Yen (Khoai Chau district): A traditional hub for basil cultivation. Recent years have seen rising basil oil prices due to reduced supply, providing strong income potential for farmers. Techvina partners with growers here to ensure quality raw material sourcing.

➤ Source - Phu Xuyen (Hanoi): Adjacent to Hung Yen, this region also contributes significantly to basil essential oil production and benefits from proximity to Techvina’s processing facilities.

- Northern provinces (Quang Nam, Ha Giang, Lao Cai, Yen Bai): Known for cinnamon and star anise—key ingredients in Techvina’s spice-based essential oils.

- Southern provinces (Dong Nai, Lam Dong, Tien Giang): Focused on lemongrass, citronella, and ginger—major products in Techvina’s natural essential oil portfolio.

5. Current Market Trends and Future Outlook (2025–2030)

5.1. Demand Surge in Wellness, Cosmetics, and Natural Pharma

The global shift towards natural and organic products has increased demand for essential oils in wellness, cosmetics, and pharmaceuticals. Vietnamese oils, particularly cinnamon, basil, and lemongrass, are gaining popularity for their quality and therapeutic benefits.

5.2. Export Data and Projections

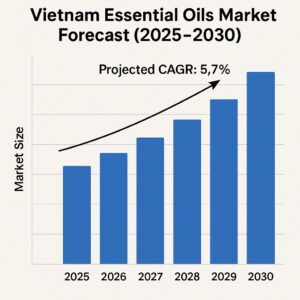

According to IMARC Group, Ken Research, and MarketResearch.com, Vietnam’s essential oil exports reached approximately USD 0.85 billion in 2023, marking a period of strong industry growth. Major importing countries include China, the United States, and India, highlighting Vietnam’s strategic importance in the global essential oils supply chain.

Looking ahead, the market is projected to grow at a compound annual growth rate (CAGR) of 5.70% from 2025 to 2030, driven by increasing global demand for natural wellness, aromatherapy, and cosmetic products.

6. Conclusion

Vietnam’s journey from traditional essential oil practices to a modern, globally recognized industry underscores its potential as a key player in the natural products market. With a commitment to quality, sustainability, and innovation, Vietnam is poised to meet the growing global demand for essential oils.